On July 2 we will be half-way through 2018.

If you made any financial new year’s resolutions, now is the time to check in and see where you are in terms of reaching those goals.

Even if you haven’t made any concrete goals, a mid-year check is key for personal money management.

Read on for 5 tips for simple financial success.

1. Review your Subscriptions

Now is a good time to go through your online banking and credit card statements to see what funds are automatically being deducted from your account each month.

Newspaper, Netflix, magazine subscriptions, audiobook services, a food delivery service subscription and so on.

Consider each in turn and determine if you still want to spend money on that subscription. If the magazines just sit in their wrapper for weeks on end, maybe it’s time to trim the fat off your expenses and cancel what you don’t use.

You might be surprised to find that that free week trial you thought you canceled is still active and costing you money. This is one of many good money habits than ensures you are not whittling down your income on un-necessary items.

2. Negotiate Your Bills

Save yourself a chunk of money each month by working to lower your bills.

Contact your internet and cell phone provider and your home and car insurance providers. Ask if there is a better price they could offer you.

Companies want to retain clients and will often lower your bills. Likely there is a bundle special you qualify for or a new plan.

For insurance, the longer you’ve gone incident-free, the less risk you are. They should be able to get you a lower price (especially around renewal time).

Come prepared with a competitor’s price and ask them to match it. Chances are they will! And if they don’t – well maybe it’s time to switch providers.

Find out more and compare the best promotions, deals, products, and discounts.

3. Review Your Get Out Of Debt Plan

80% of Americans have debt. Not just mortgage but also car, medical bills, and credit card debt.

Millennials have $4,868 of credit card debt on average, compared to $7,175 for baby boomers and $8,291 for Gen Xers.

If you already have a debt repayment plan, mid-year is an excellent time to look closely at where you are. Are you where you should be to get to you December 31 goal? Or is it time to recommit?

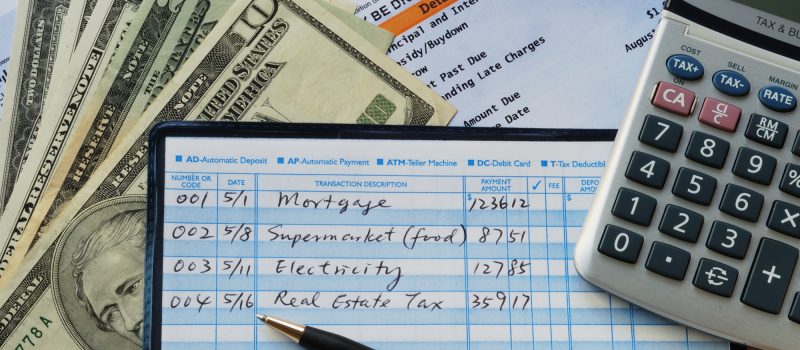

4. Review your Spending

One of the simplest, but most effective personal finance tips is to take time at the end of every month to review your spending.

Go through your banking statement and your credit card and tall up what you spent on eating out, clothes, groceries etc. Knowing what you are actually spending will help you be able to set a realistic budget.

If you normally spend $150 a month on eating out and take out. Set a goal to reduce that down to $100 each month. Or cut that cost in half you want to be aggressive with your savings goals.

Feel free to use apps or online budget calculator to sort monthly income and expenditures. This will help you see where your money is being spent and identify opportunities to save more.

5. Review Your Retirement Savings

How to be good with money is largely about planning for the future instead of thinking about today.

Review your retirement contributions and ensure that your asset allocation is appropriate for your current age. You should be saving 10-15% of your income to for your retirement.

If possible, increase your monthly contributions. Many workplaces have a retirement savings match program. Make sure you are contributing to that.

If you aren’t sure where or how much you should be saving. Search out for a professional in your State who can help you make sure you are on track.

Final Thoughts on Personal Finance Tips

We hope these 5 personal finance tips have been helpful for you. Remember, the more you focus on your spending and your savings, the better position you will be in for the longrun.

Check out Find a Business That to find companies in your city for any services you need, including financial consulting.